39 bond price zero coupon

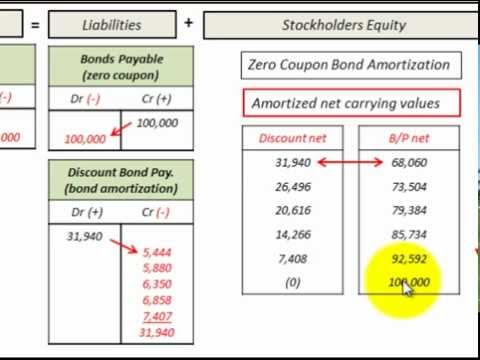

US Treasury Zero-Coupon Yield Curve US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,278 datasets) Refreshed 2 days ago, on 22 Apr 2022 Frequency daily Description These yield curves are... open.lib.umn.edu › financialaccounting › chapter14.3 Accounting for Zero-Coupon Bonds – Financial Accounting Identify the characteristics of a zero-coupon bond. Explain how interest is earned on a zero-coupon bond. Understand the method of arriving at an effective interest rate for a bond. Calculate the price of a zero-coupon bond and list the variables that affect this computation.

S&P U.S. Treasury Principal STRIPS Index | S ... - S&P Global S&P U.S. Treasury Principal STRIPS Index. Launch Date: May 03, 2018. Total Return 2.92 %. 1 Yr Return -12.27%. The index Launch Date is May 03, 2018. All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date.

Bond price zero coupon

Types of Debentures | Basis - Redemption, Convertibility ... No Coupon Rate Zero Coupon and Specific Rate Debentures Zero-coupon debentures do not carry any coupon rate, or we can say that there is a zero-coupon rate. The debenture holder will not get any interest in these types of debentures. ICE BofA US High Yield Index Option-Adjusted Spread ... Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify for inclusion in the Index. Callable perpetual securities qualify provided they are at least one year from the first call date. ICE BofA Emerging Markets Corporate Plus Index Option ... Other types of securities acceptable for inclusion in this index are: original issue zero coupon bonds, "global" securities (debt issued in the US domestic bond markets as well the Eurobond Market simultaneously), 144a securities, pay-in-kind securities (includes toggle notes), callable perpetual securities (qualify if they are at least one ...

Bond price zero coupon. About Traded on CM - NSE India They are zero coupon short-term bonds They have maturity less than a year of 91 days, 182 days & 364 days T-bills are issued at a discount and mature at par value of the bond South Africa Government Bonds - Yields Curve South Africa Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. Investment Maturity Investment result Investing in South Africa Government people.stern.nyu.edu › jcarpen0 › coursesTreasury Bond Futures - New York University factor equal to the price of $1 par of the bond at a yield of 6%. If the seller delivers a given bond, he receives the futures price, times the conversion factor, plus accrued interest. The seller’s net cash flow from delivering is G x CF(i) – Price of Bond i Cheapest-to-Deliver with No Conversion Factors: Suppose all bonds have a 6% coupon Zero-coupon bond | Business & Finance homework help ... Here are the charts for the last two questions …Question 15.13 In addition to the zero-coupon bond, investors also may purchase a 3-year bond making annual payments of $ 45 with par value $ 1,000. a. What is the price of the coupon bond? b. What is the yield to maturity of the coupon bond? c.

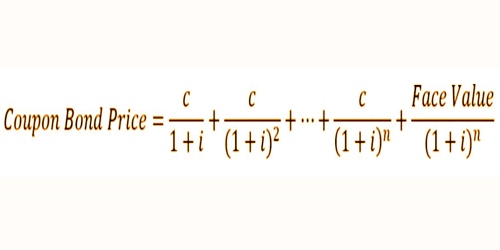

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. VanEck Investment Grade Floating Rate ETF - ETFdb.com Whereas most bond ETFs invest exclusively in debt that pays a fixed coupon over the life of the note, this ETF holds debt that adjusts its coupon payment based on a reference rate. As a result, there is minimal interest rate risk associated with this fund, as the effective duration is close to zero. BANK OF AMERICA CORP. Bond | Markets Insider The Merrill Lynch & Co. Inc.-Bond has a maturity date of 6/1/2028 and offers a coupon of 6.7500%. The payment of the coupon will take place 2.0 times per biannual on the 01.12.. › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ...

Accounts That Earn Compounding Interest - The Motley Fool A zero coupon bond holder purchases a bond at a steep discount, receives no interest payments (coupons) in exchange for holding the bond, and is paid the bond's face value when the bond is due. Feature Of Zero Coupon Bond - solved you buy a zero coupon ... Feature Of Zero Coupon Bond - 17 images - what is a zero coupon bond definition and meaning fortunez, the ultra verse mill creek entertainment, zero coupon bond issued at discount amortization and accounting journal entries youtube, 6 how to create coupon in excel sampletemplatess sampletemplatess, Bonds - REC Limited Foreign Currency Bonds. Post-issuance certification from Climate Bond Initiative, London; REC Green Bond Framework; Certificate from Climate Bond Initiative, London; Annual Update Report for Green Bonds as on March 31, 2021; Tax Free Bond; Infrastructure Bonds; Taxable Bond; Forms for Bonds; Market Linked Debentures AT & T INC.DL-NOTES 2019(19/39) Bond | Markets Insider The AT & T Inc.-Bond has a maturity date of 3/1/2039 and offers a coupon of 4.8500%. The payment of the coupon will take place 2.0 times per biannual on the 01.09.. At the current price of 102.852 ...

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price ... Zero Coupon Bond Calculator Outputs. Market Price ($): The market price of the bond, or its true value to fit the input criteria. What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value).

What is a Zero-Coupon Bond? Definition, Features, Advantages, Calculation, Example, Limitations ...

5 ETFs That Saw Inflows Last Week It seeks to provide exposure to zero coupon U.S. Treasury securities with remaining maturity of 1-3 months. It follows the Bloomberg 1-3 Month U.S. Treasury Bill Index, holding 14 securities in ...

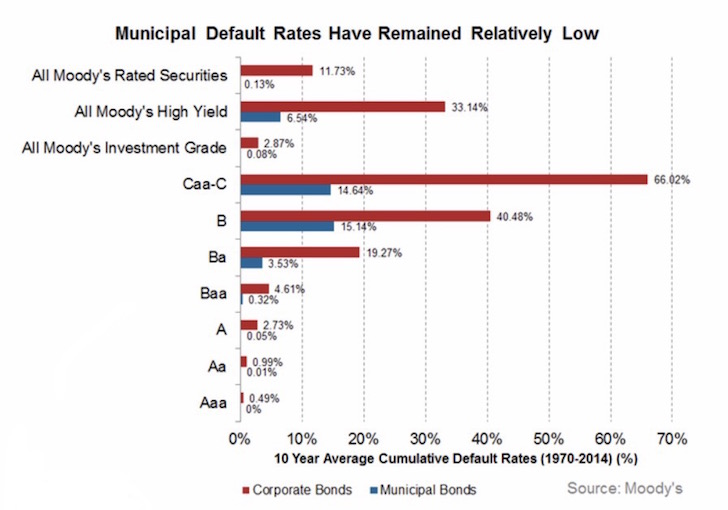

martini.ai: KONINKLIJKE KPN NV 2073 7.0% (BBG0046VBL25 ... This is easily seen in the neighborhood price-action graph for Petroleos Mexicanos and Netflix on April 17, 2020. While Petroleos Mexicanos is an investment grade bond, it has traded like a high yield bond. On the other hand, Netflix, rated as a high-yield bond, has traded like an investment bond.

Bonds and bond valuation | Business & Finance homework help 13. Zero-coupon bond. Addison Company will issue a zero coupon bond this coming month. The projected yield for the bond is 7%. If the par value of the bond is $1,000, what is the price of the bond using a semiannual convention if a. The maturity is 20 years? b. The maturity is 30 years? c. The maturity is 50 years? d. The maturity is 100 years?

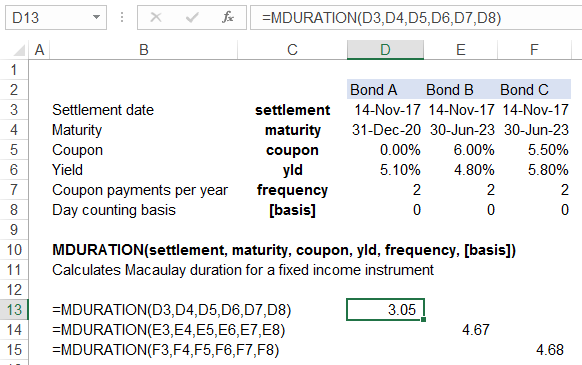

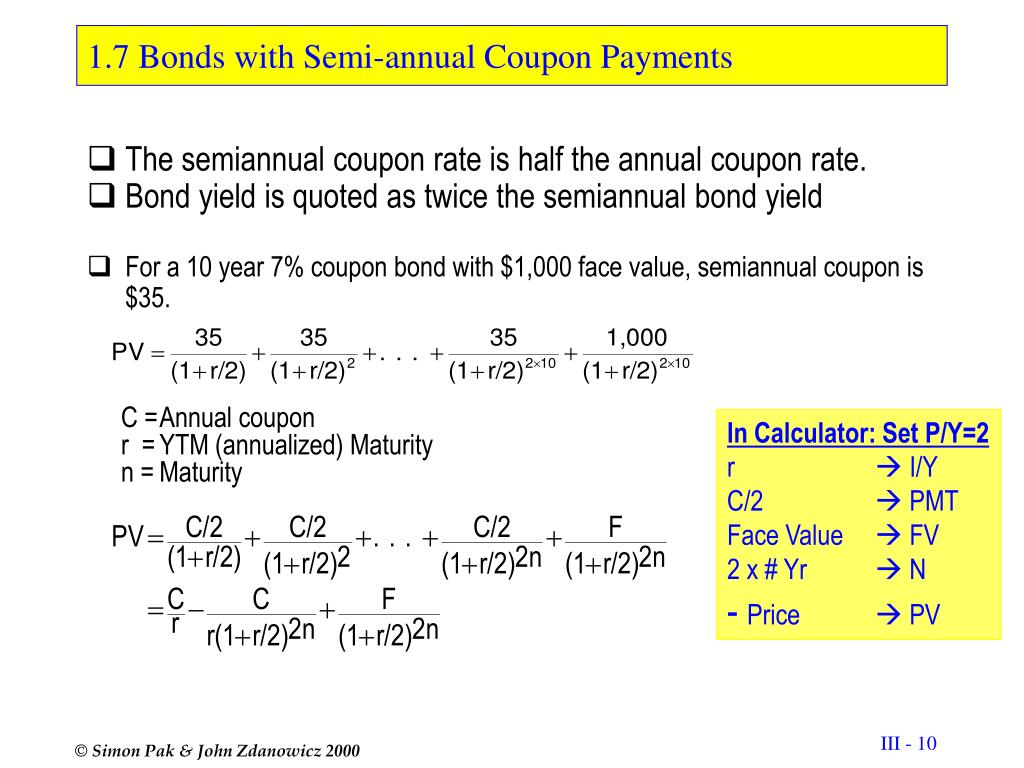

Compute the price of a 6.4 percent coupon bond with ten ... Compute the price of a 6.4 percent coupon bond with ten years left to maturity and a market interest rate of 8.0 percent. (Assume interest payments are semiannual.) (Do not round intermediate calculations and round your final answer to 2 decimal places.)

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond;

Perù Government Bonds - Yields Curve Perù Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. Investment Maturity Investment result

Corporate FIN - Academia Essay Writers A bond pays a coupon interest rate of 7.5%. The market rate on similar bonds is 8.4%. The bond will sell at _____.

Post a Comment for "39 bond price zero coupon"