41 treasury bills coupon rate

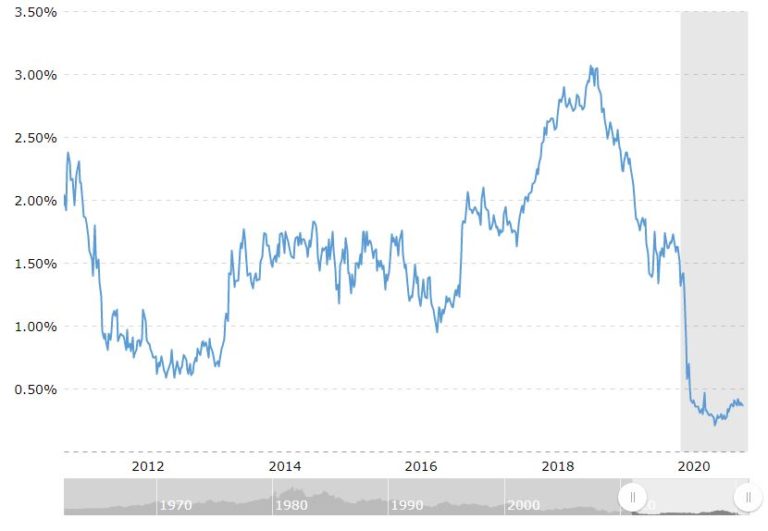

Understanding Coupon Rate and Yield to Maturity of Bonds ... The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bill (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

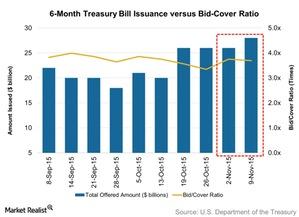

Treasury Bills (T-Bills) Definition As stated earlier, the Treasury Department auctions new T-bills throughout the year. On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face...

Treasury bills coupon rate

United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. Treasury I-Bonds are Paying 7.12%! — Sapient Investments Right now, the fixed rate is zero (and has been since November 1, 2019). Because the latest 6-month increase in the CPI (3.56%) rose at an annualized rate of 7.12%, that is the current yield for I-bonds. If the CPI cools, the yield may decline, but can never become negative. Consequently, the accrued value of an I-bond can never decline. Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms . Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest. The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions.)

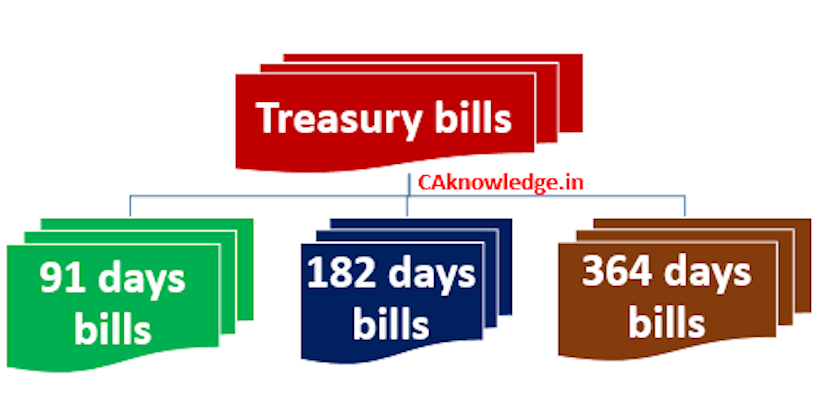

Treasury bills coupon rate. Treasury Bills vs Bonds | Top 5 Best Differences (With ... Treasury Bills. Treasury bills categories into 3 bills as per maturity namely, a) 91 Day b) 182 Day c) 364 Day. Treasury bills are sold out at a discounting price, and it did not pay any interest. Treasury Bills is also called as T-Bills. A treasury bill is only typed instrument which is found in both capital and money market. Treasury Rates, Interest Rates, Yields - Barchart.com Treasury Rates. This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. Click on any Rate to view a detailed quote. Treasury bills, notes and bonds are sold by the U.S. Treasury Department. Frequently Asked Questions - Newly Added - home.treasury.gov The Director of OFAC, in consultation with the State Department, has issued a determination pursuant to E.O. 14024 that authorizes the imposition of economic sanctions against persons that operate or have operated in the accounting, trust and corporate formation services, or management consulting sectors of the Russian Federation economy. Treasury Bills (T-Bills) - What They Are & How to Buy for ... The Treasury auctions T-bills to investors, who purchase the security at a discount to the face value. For example, an investor may purchase a bill with a $1,000 face value and a six-month maturity at a price of $950. In six months, when the investment matures, the investor receives $1,000, producing $50 in profit.

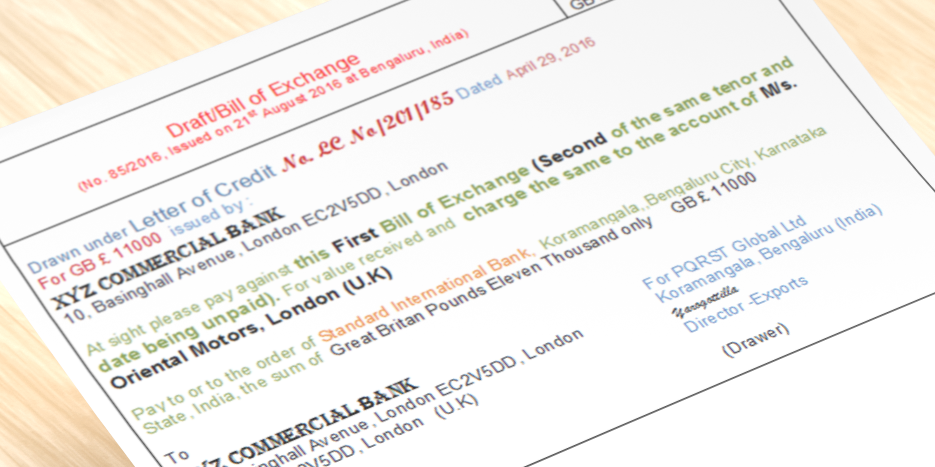

India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-. Treasury Bills vs Bonds | Top 5 Differences (with ... T-bills do not pay any coupon. They are floated as a zero-coupon bond to the investors, they are issued at discounts, and the investors receive the face value at the end of the tenure, which is the return on their investment. Bonds pay interest in the form of a coupon to the investors quarterly or semi-annually. How Are Treasury Bill Interest Rates Determined? For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the... U.S. Treasury Bonds, Bills and Notes: What They Are and ... Treasury bills (or T-bills): Short-term debt securities that mature in less than one year. Though T-bills are sold with a wide range of maturities, the most common terms are for four, eight, 13 ...

A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon . Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity. Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured. Investing in Treasury Bills: The Safest Investment in 2022 A Treasury bill is any bond issued with a maturity of one year or less. Treasury notes have maturities from two to 10 years. And Treasury bonds mature 20 years or later. (For simplicity, this article refers to all three as "Treasury bills" or "T-bills" or simply "Treasuries.") Treasury bills are seen as the safest bonds in the world ... How does the U.S. Treasury decide what coupon rate to ... Answer (1 of 3): The coupon is usually set close to yield within typical rates i.e. 1/16th or 1/32 to generate a near par price. Trading too far away from par will either raise less money or reduce the appetite for investors if it is purchased way above par. The new issue or on-the-run can also ...

US Treasury Bonds - Fidelity Investments The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

What are coupons in treasury bills/bonds? - Quora Treasury bonds and bills have a coupon rate. The coupon rate is the interest rate on the par value of the bond that the bondholder receives annually. Since these securities almost never sell at par, the coupon rate almost never corresponds to the return the investor will receive by Continue Reading Louis Cohen , took Fischer Black's finance class

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ...

Individual - Treasury Bills In Depth Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000.

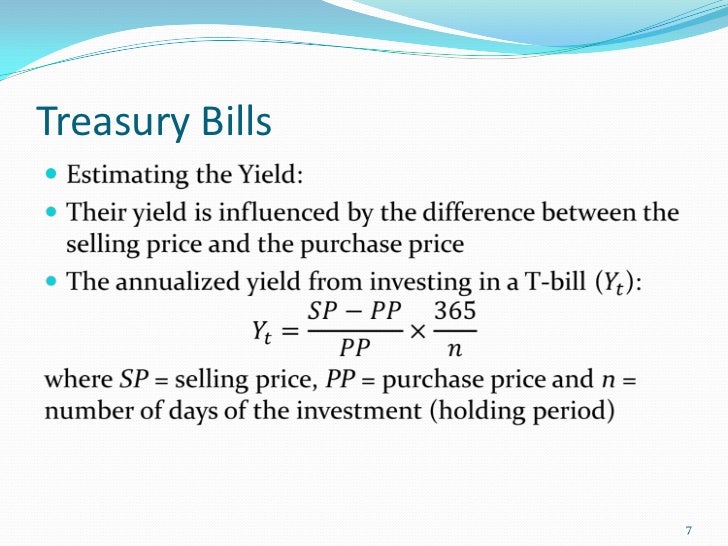

Treasury Bills - Types, Features and Advantages of ... Yield Rate on Treasury Bills The percentage of yield generated from a treasury bill can be calculated through the following formula - Y = (100-P)/P x 365/D x 100 Where Y = Return per cent P = Discounted price at which a security is purchased, and D = Tenure of a bill Let us consider a treasury bills example for better understanding.

Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction.

Reserve Bank of India Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. ii) Floating Rate Bonds (FRB) - FRBs are securities which do not have a fixed coupon rate.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate remains fixed over the lifetime of the bond, while the yield-to-maturity is bound to change. When calculating the yield-to-maturity, you take into account the coupon rate and any increase or decrease in the price of the bond. ... Examples of zero-coupon bonds include U.S. Treasury bills and U.S. savings bonds. Insurance ...

What Is a Treasury Note? How Treasury Notes Work for Beginners A Treasury note is a type of U.S. government debt security with a set interest rate and a maturity period ranging from one to ten years. Interest rates are determined at the federal level, just like a Treasury bond or a Treasury bill. Treasury notes are highly common investments because they are available on the secondary market.

Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms . Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest. The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions.)

Treasury I-Bonds are Paying 7.12%! — Sapient Investments Right now, the fixed rate is zero (and has been since November 1, 2019). Because the latest 6-month increase in the CPI (3.56%) rose at an annualized rate of 7.12%, that is the current yield for I-bonds. If the CPI cools, the yield may decline, but can never become negative. Consequently, the accrued value of an I-bond can never decline.

United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA.

Post a Comment for "41 treasury bills coupon rate"