42 present value of coupon bond

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Bond Price Calculator - Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

How to Figure Out the Present Value of a Bond - dummies Use the present value factors to calculate the present value of each amount in dollars. The present value of the bond is $100,000 x 0.65873 = $65,873. The present value of the interest payments is $7,000 x 3.10245 = $21,717, with rounding. Add the present value of the two cash flows to determine the total present value of the bond.

Present value of coupon bond

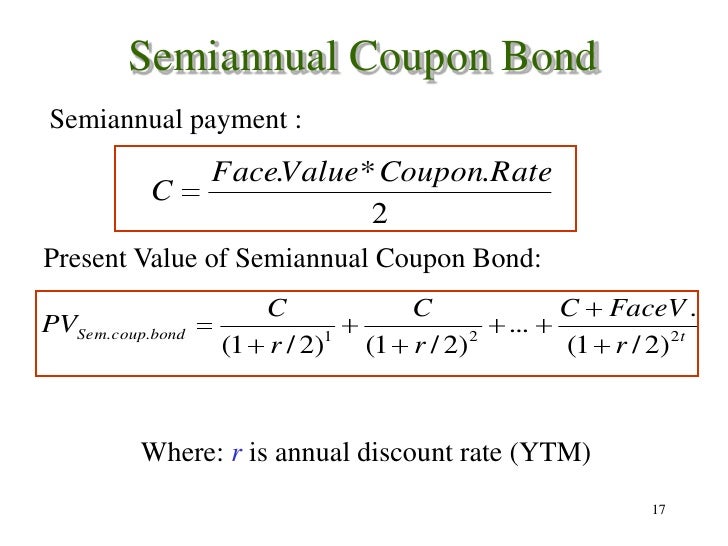

Bond Valuation - Present Value of a Bond, Par Value, Coupon Payments ... The Present Value of a Bond = The Present Value of the Coupon Payments ( an annuity) + The Present Value of the Par Value ( time value of money) Example Par Value = $ 1,000 Maturity Date is in 5 years Annual Coupon Payments of $100, which is 10% Market Interest rate of 8% The Present Value of the Coupon Payments ( an annuity) = $399.27 Coupon Bond Formula | Examples with Excel Template Coupon Bond = $1,033 Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation The formula for coupon bond can be derived by using the following steps: Bond Valuation Definition - Investopedia Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the...

Present value of coupon bond. How to Calculate PV of a Different Bond Type With Excel The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate... Valuing Bonds | Boundless Finance | | Course Hero The formula for calculating a bond's price uses the basic present value (PV) formula for a given discount rate. Bond Price: Bond price is the present value of coupon payments and face value paid at maturity. Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3. How to calculate the present value of a bond - AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor.

Solved c) Calculate the Present Value of a zero-coupon bond | Chegg.com c) Calculate the Present Value of a zero-coupon bond with nominal value 1 million pounds and yield to maturity 6% pa and time to maturity equal to 10 years. Find the duration of the zero-coupon bond. an Calculation of the Value of Bonds (With Formula) Find present value of the bond when par value or face value is Rs. 100, coupon rate is 15%, current market price is Rs. 90/-. ... A Rs. 100/- par value bond carries a coupon rate of 16% interest payable semi-annually and has a maturity period of 10 years. If an investor required rate of return (Discount rate) for this bond is 85 for six months ... Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments)

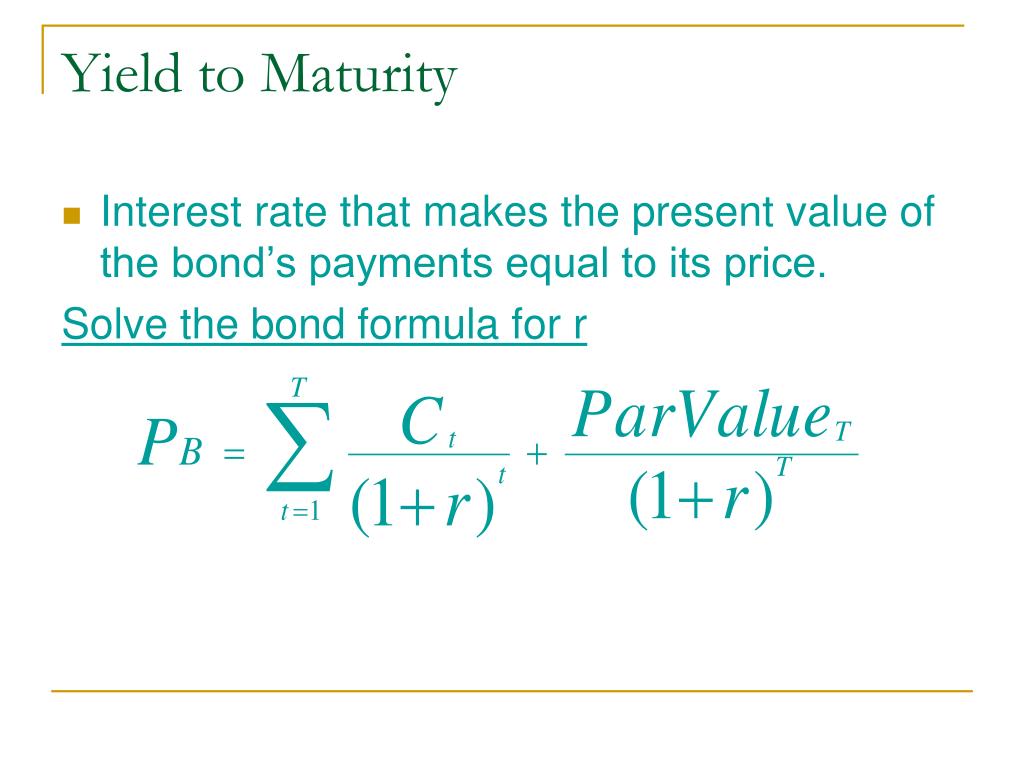

Solved Calculate the Present Value of a zero-coupon bond | Chegg.com Find the duration of the zero-coupon bond. Question: Calculate the Present Value of a zero-coupon bond with nominal value 1 million pounds and yield to maturity 6% pa and time to maturity equal to 10 years. Find the duration of the zero-coupon bond. How to Calculate the Price of Coupon Bond? - WallStreetMojo The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] Excel formula: Bond valuation example | Exceljet The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates Coupon Payment | Definition, Formula, Calculator & Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. They carry a coupon rate of 6.5% while the payments are made semiannually. Its current yield is 4.63% while its yield to maturity is 3.92%. The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2].

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond.

Coupon Rate Formula | Step by Step Calculation (with Examples) The par value of the bond is $1,000, and it is trading $950 in the market. Determine which statement is correct: Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100

calculating the present value of a bond | StudyBlue calculating the present value of a bond. Get your original paper written from scratch starting at just $10 per page with a plagiarism report and free revisions included! 4. (calculating the present value of a bond) If a corporate bond with a face value of $1,000 has 24 years to go until it matures, has a coupon interest rate of 5.7% and a yield ...

Bond Valuation: Formula, Steps & Examples - Study.com The value of a bond is the present value sum of its discounted cash flows. Bonds have a face value, a coupon rate, a maturity date, and a discount rate. ... For example, find the present value of ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%.

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond Coupon bond = $40* [ (1- (1+7%/2))^ (-12)) / (7%/2) ] + [$1,000/ (1+7%/2)^12] Coupon Bond = $951.68 Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market.

How to Calculate Present Value of a Bond - Pediaa.Com A bond is a financial debt instrument. Calculating present value of a bond involves discounting coupon income based on the market interest rate plus discounting the face value of the bond after the maturity period. This value represents the current value of the future cash flows that will be generated by this instrument. Save

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Post a Comment for "42 present value of coupon bond"