39 the coupon rate of a bond is equal to

[Solved] For a bond YTM is always equal to coupon rate. - McqMate A bond that makes no coupon payments (and thus is initially priced at a deep discount to par value) is called a_____ bond. The annual coupon of a bond divided by its face value is called the bond: Required rate of return>Coupon rate, the bond will be valued at; If the coupon rate is constant, the value of bond when close to maturity will be; An ... Will the actual realized yields be equal? When can current yield and coupon rate be same? Now the current market price of bonds is $1800, so the current yield can be calculated, which results in the current yield equals to 8.33%. The Current Yield can be equal to the coupon rate in some rare cases when a bond market price gets equal to its face value.

What is 'Coupon Rate' - The Economic Times The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market.

The coupon rate of a bond is equal to

When the coupon rate of a bond is equal to the - Course Hero When the coupon rate of a bond is equal to the current interest rate, the bond will sell for face value. The discount rate that makes the present value of the bond's payments equal to its price is known as the yield to maturity. yield to maturity . Difference Between Coupon Rate and Discount Rate What is Coupon Rate? Coupon rates are generally affected by the loan fees set by the government.1 Subsequently, on the off chance that the public authority expands the base financing cost to 6%, any previous securities with coupon rates beneath 6% lose esteem. The coupon rate is communicated as a level of its standard capital. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

The coupon rate of a bond is equal to. When the coupon bond is priced at its face value, does the yield to ... The Coupon Rate is 9%. It pays $90 per year since it was issued $90 is 9% of the original $1000 investment. The Bond Yield (aka, Current Yield) is 10%. 10% is your return this year, if you buy the bond at today's prices $90 is 10% of your $910 investment. The Yield to Maturity (YTM) is 13%. It's the only number that really matters. When a Bond's Coupon Rate Is Equal to Yield to Maturity The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year. So if... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). Solved If the coupon rate of a bond is equal to its required - Chegg This problem has been solved! See the answer If the coupon rate of a bond is equal to its required rate of return, then ________. Select one: a. the current value is not equal to par value b. the current value is equal to par value c. the maturity value is equal to par value d. the current value is equal to maturity value Expert Answer

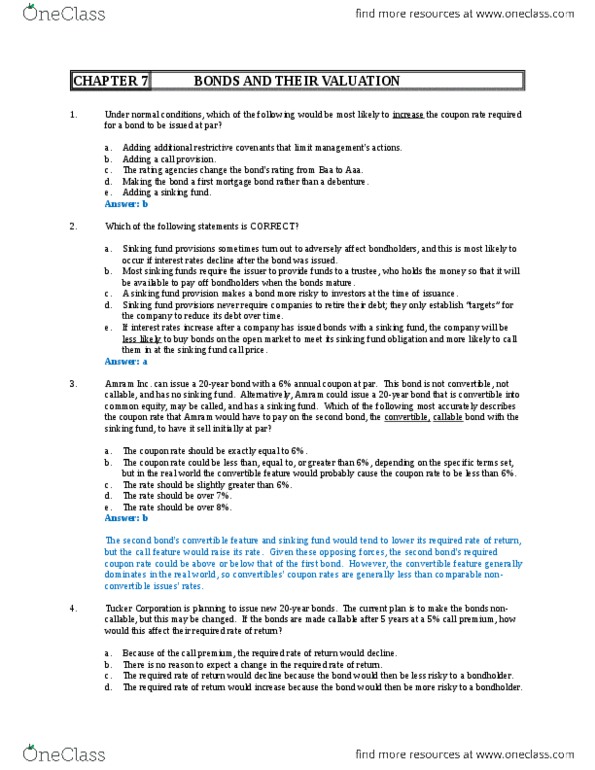

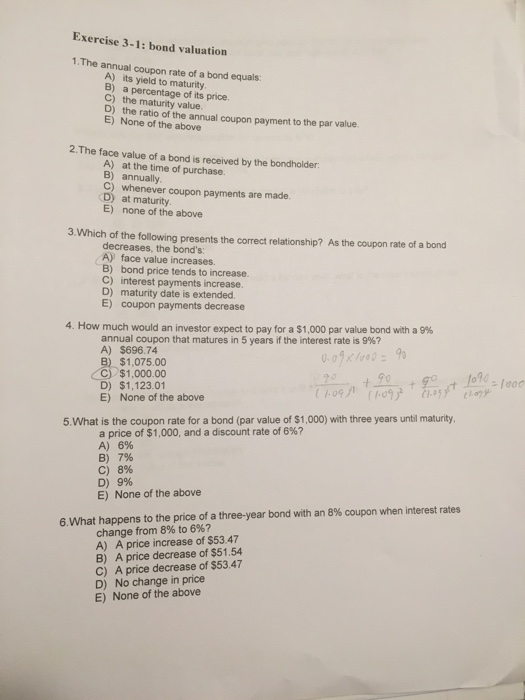

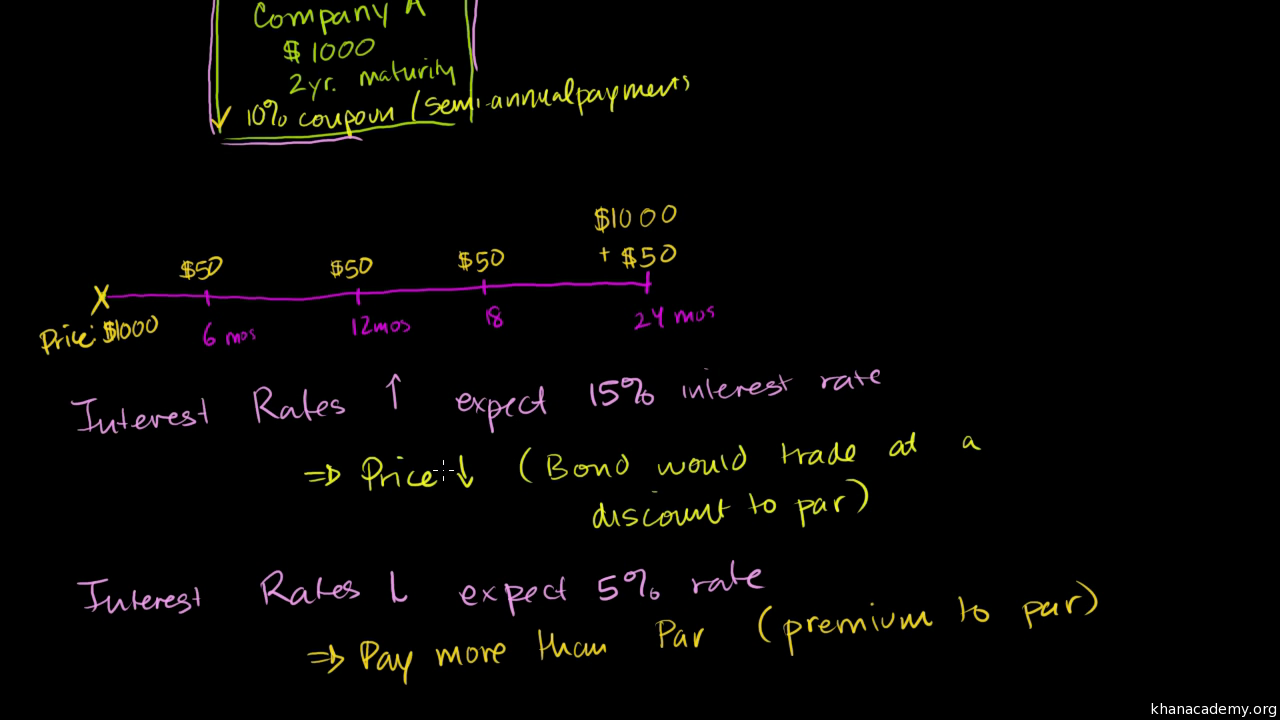

Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. Coupon Rate Definition - Investopedia 28.05.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Solved 1. The annual coupon rate of a bond equals: | Chegg.com 1. The annual coupon rate of a bond equals: A) its yield to maturity. B) a percentage of its price. C) the maturity value. D) the ratio of the annual coupon payment to the par value. E) None of the above. 2. The face value of a bond is received by the bondholder: A) at the time of purchase. B) annually. C) whenever coupon payments are made. Zero-Coupon Bond - Definition, How It Works, Formula 28.01.2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than …

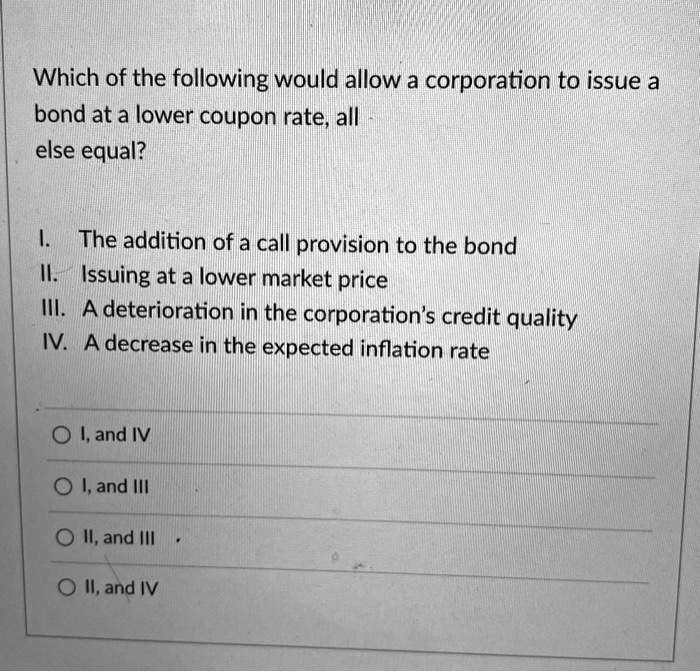

All else constant, a bond will sell at _____ when the coupon rate is ... All else constant, a bond will sell at _____ when the coupon rate is _____ the yield to maturity. 1.A premium; equal to, 2.Par; less than, 3.A discount; less than, 4.A discount; higher than, 5.A premium; less than Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,... What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. OneClass: A bond's coupon rate is equal to the annual interest divided ... A bond's coupon rate is equal to the annual interest divided by which one of the following? A) call price. B) current price. C) face value. D) clean price. E) dirty price. Show full question + 20 Watch For unlimited access to Homework Help, a Homework+ subscription is required. papayaprofessor Lv10 5 Sep Unlock all answers

Zero-Coupon Bond Definition - Investopedia 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

If the coupon rate of a bond is equal to its required bond E will have a greater change in price 31) Hewitt Packing Company has an issue of $1,000 par value bonds with a 14 percent annual coupon interest rate. The issue has ten years remaining to the maturity date. Bonds of similar risk are currently selling to yield a12 percent rate of return. The current value of each Hewitt bond is ________.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

While calculating the cost of debt, why isn't the coupon rate of a bond ... The coupon rate is the face rate of the payment of annual interest for the bond. The interest is usually paid every six months. The yield to maturity includes a discounting of all future payments to the investor somewhat like an Internal Rate of Return.

Finance Ch 6 Flashcards | Quizlet What condition must exist if a bond's coupon rate is to equal both the bond's current yield and its yield to maturity? Assume the market rate of interest for this bond is positive. A. The clean price of the bond must equal the bond's dirty price. B. The bond must be a zero coupon bond and mature in exactly one year. C.

Municipal Bond Calculator | Muni Bond Calculator Annual Coupon Rate. The rate of interest the municipal bond pays to its holders annual as a percentage of the par value. Federal Tax Bracket ... to equal the after tax rate of return calculated by the yield to maturity. YTM vs TEY Difference. 2.634%. YTM vs TEY Difference . The tax equivalent yield minus the yield to maturity. Total Coupon Cash Flow. $10,000. Total Coupon …

Excel formula: Bond valuation example | Exceljet In the example shown, we have a 3-year bond with a face value of $1,000. The coupon rate is 7% so the bond will pay 7% of the $1,000 face value in interest every year, or $70. However, because interest is paid semiannually in two equal payments, there will be 6 coupon payments of $35 each. The $1,000 will be returned at maturity. Finally, the ...

If coupon rate is equal to going rate of interest then - Examveda Solution (By Examveda Team) If coupon rate is equal to going rate of interest then bond will be sold at par value. A coupon payment on a bond is the annual interest payment that the bondholder receives from the bond's issue date until it matures. Coupons are normally described in terms of the coupon rate, which is calculated by adding the sum ...

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value.

If the coupon rate of a bond is equal to its required rate of return ... When the coupon rate of a bond equal to its required rate of return, then it is purchased at par since the initial investment is totally offset by repayment of the bond at maturity, leaving only the fixed coupon payments as profit. The correct answer is - is equal to par value. Advertisement

Finance Chapter 6 (Practice Questions) Flashcards | Quizlet A measure of return that takes account of both coupon payments and change in a bond's value over its life is a standard measure known as face value The payment made when a bond matures is called the bond's: face value When the coupon rate of a bond is equal to the current interest rate, the bond will sell for coupon payment, interest rate

How to Price Bonds With Floating Rates | Finance - Zacks The price of a bond is the invoice price - the amount you pay to buy it, not counting commissions or accrued interest - divided by its face value. For example, the price of a $1,000 face value ...

Floating rate note - Wikipedia Floating rate notes (FRNs) are bonds that have a variable coupon, equal to a money market reference rate, like LIBOR or federal funds rate, plus a quoted spread (also known as quoted margin). The spread is a rate that remains constant. Almost all FRNs have quarterly coupons, i.e. they pay out interest every three months. At the beginning of each coupon period, the coupon …

Difference Between Current Yield and Coupon Rate Now the current market price of bonds is $1800, so the current yield can be calculated, which results in the current yield equals to 8.33%. The Current Yield can be equal to the coupon rate in some rare cases when a bond market price gets equal to its face value.. It is higher when the bond market price gets lower than its face value, and it is lower when the bond market price is higher than ...

What Is Bond Valuation? - The Balance 22.10.2021 · How Bond Valuation Works . A bond’s face value, or par value, is the amount an issuer pays to the bondholder once a bond matures. The market price of a bond, which equals the present value of its expected future cash flows, or payments to the bondholder, fluctuates depending on a number of factors, including when the bond matures, the creditworthiness of …

bond - Why does the YTM equal the coupon rate at par? - Quantitative ... Intuitively and academically, a bond cannot be worth more than the sum of the future cashflows plus future value. In the case of yield equaling coupon rate, the price is equal to par because the rate at which you are discounting makes it so that the sum of the discounted cashflows and discounted par equal present par. Understanding this, by ...

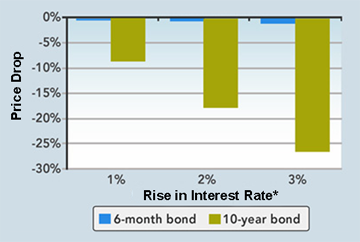

How the Fed's rate increase may affect your bond portfolio - CNBC 16.03.2022 · For example, let's say you have a 10-year $1,000 bond paying a 3% coupon. If market interest rates rise to 4% in one year, the asset will still pay 3%, but the bond's value may drop to $925.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples. Let us take the example of a bond with quarterly coupon payments. Let us assume a company XYZ Ltd has issued a bond having a face value of $1,000 and quarterly interest payments of $15. If the …

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

Difference Between Coupon Rate and Discount Rate What is Coupon Rate? Coupon rates are generally affected by the loan fees set by the government.1 Subsequently, on the off chance that the public authority expands the base financing cost to 6%, any previous securities with coupon rates beneath 6% lose esteem. The coupon rate is communicated as a level of its standard capital.

When the coupon rate of a bond is equal to the - Course Hero When the coupon rate of a bond is equal to the current interest rate, the bond will sell for face value. The discount rate that makes the present value of the bond's payments equal to its price is known as the yield to maturity. yield to maturity .

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "39 the coupon rate of a bond is equal to"