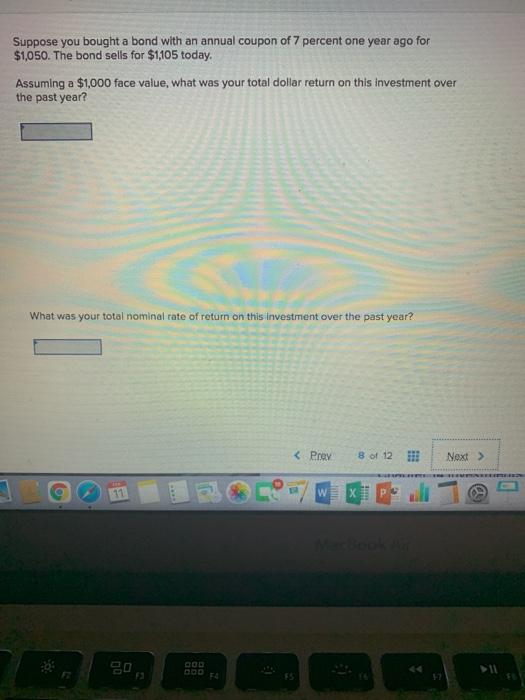

44 suppose you bought a bond with an annual coupon of 7 percent

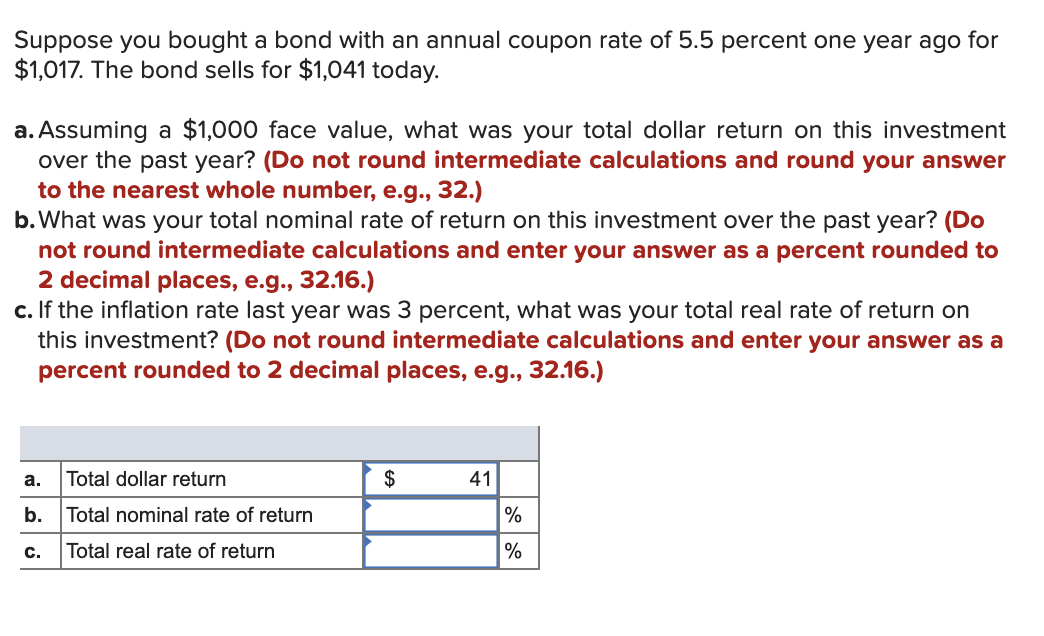

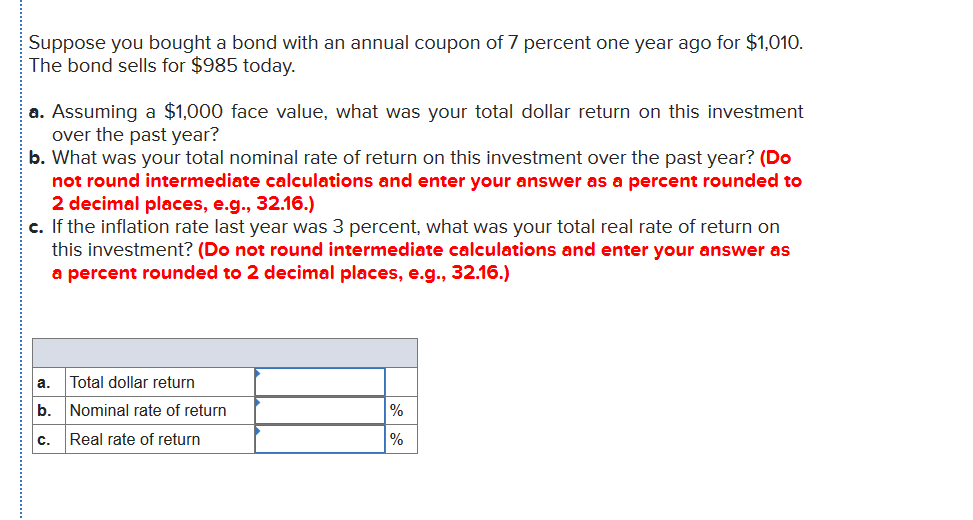

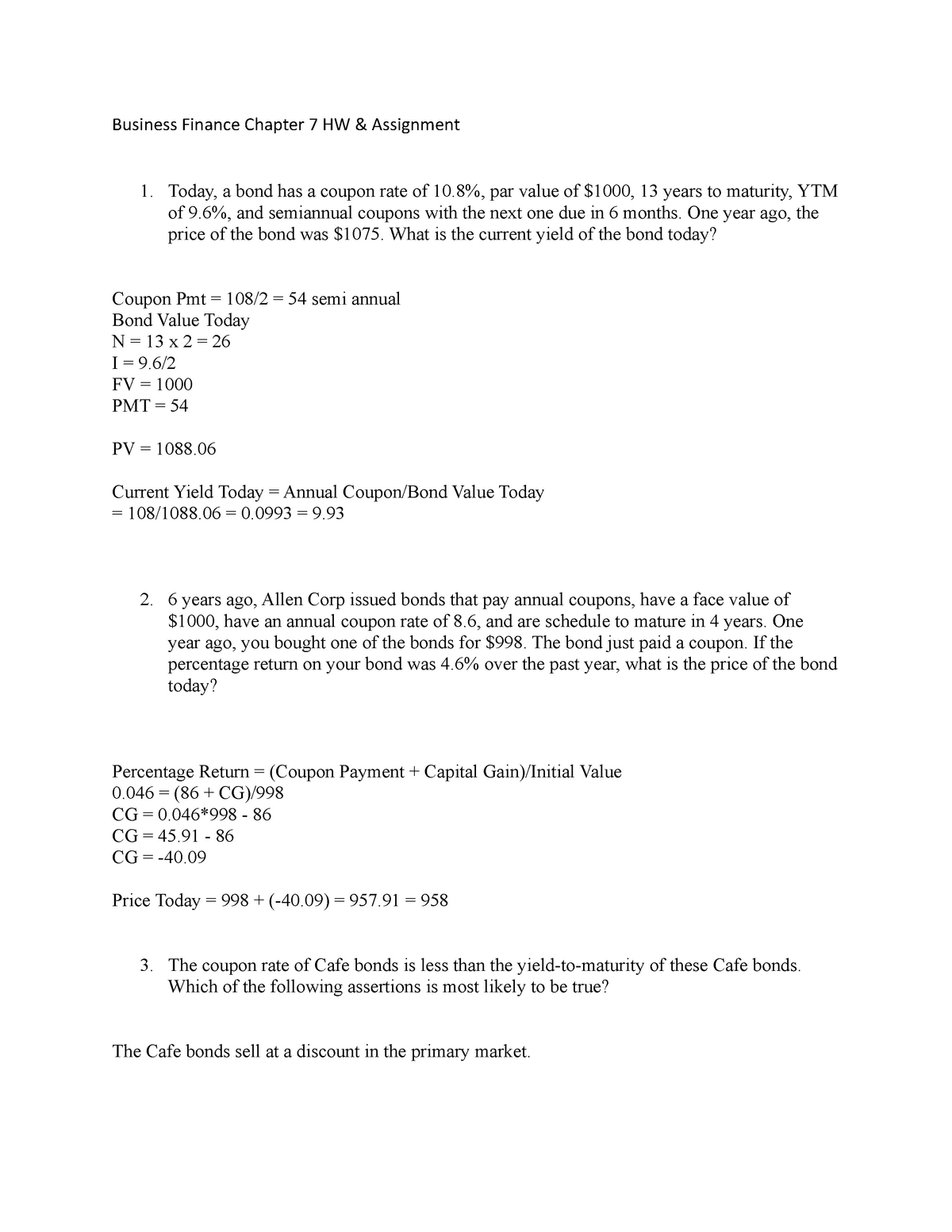

Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Solved Suppose you bought a bond with an annual coupon of 7 - Chegg Transcribed image text: Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year?

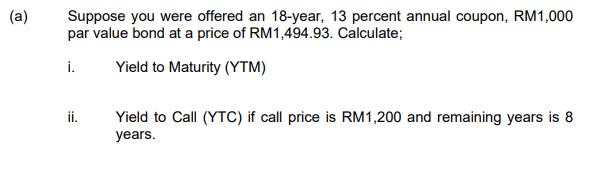

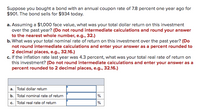

(PDF) Multiple Choice Questions and Answers:Capital Structure ... Jan 16, 2014 · the company the investor requires a n annual return of 13 percent. The company's share price is still cum div and the c urrent divi dend (to be pai d sh ortly) is 23p pe r share.

Suppose you bought a bond with an annual coupon of 7 percent

Accounting Terminology Guide - Over 1,000 Accounting and Aug 10, 1993 · Coupon INTEREST rate on a DEBT SECURITY the ISSUER promises to pay to the holder until maturity, expressed as an annual percentage of FACE VALUE. Coupon Bond A BOND that is usually not registered with the issuing CORPORATION but instead bears interest coupons stating the amount of INTEREST due and the payment date. Suppose you bought a bond with an annual coupon rate of 7...get 5 Answer of Suppose you bought a bond with an annual coupon rate of 7 percent one year ago for $860. The bond sells for $890 today. a. Assuming a $1,000 face... Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

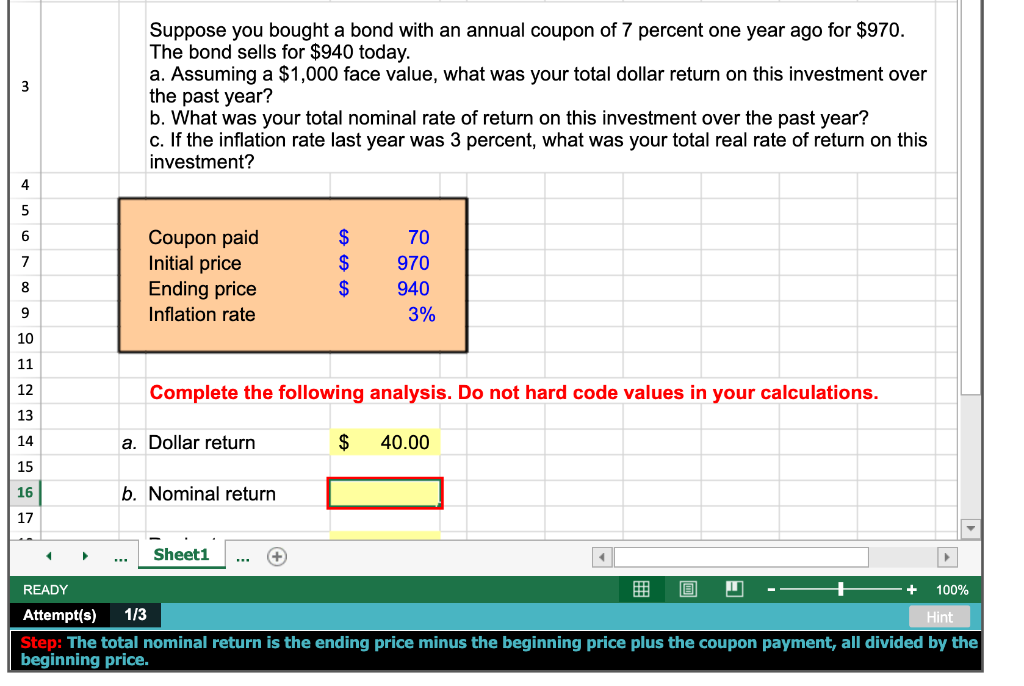

Suppose you bought a bond with an annual coupon of 7 percent. Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? Chapter 10 Finance Flashcards | Quizlet To calculate the dollar return, we multiply the number of shares owned by the change in price per share and the dividend per share received. The total dollar return is: Dollar return = 270 ($82.84 - 76.33 + 1.45) Dollar return = $2,149.20 Suppose you bought a bond with an annual coupon rate of 7.8 percent one year ago for $901. Course Help Online - Have your academic paper written by a … Ensure you request for assistant if you can’t find the section. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area, number of pages, urgency, and academic level. After filling out the order form, you fill in the sign up details. Calculating returns suppose you bought a bond with an - Course Hero Calculating Returns Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year?

How to Calculate Bond Total Return: 3 Ways to Assess the ... - wikiHow Nov 5, 2020 · In either case, you still receive interest payments based on the face value and coupon rate of the bond. The annual interest payments on the bond are $50,000 ($500,000 * .10 = $50,000). When a bond matures, you get the face value of the bond. Whether you bought the bond at a discount or a premium, upon maturity you receive the face value. Finance Final Exam chapters 10,11,12,&13 Flashcards | Quizlet A bond had a price of $946.58 at the beginning of the year and a price of $982.90 at the end of the year. The bond's par value is $1,000 and its coupon rate is 5.9 percent. What was the percentage return on the bond for the year? Bond return= ($982.90 - $946.58 +59)/ $946.58 bond return= .1007, or 10.07% chapter 10 quiz Answered: How is the value of a bond determined?… | bartleby f. How does the calculation for valuing a bond change if semiannual payments are made? Find the value of a 10-year, semiannual payment, a 10 percent coupon bond if investor’s required rate of return is 13%. 1. What is the bond's yield to call (YTC)? 2. If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why? Answered: 4. Calculating Returns [LO1] Suppose… | bartleby Calculating Returns [LO1] Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? c.

FIN/370 - Suppose you bought a bond with an annual coupon of 7 percent ... FIN/370 - Suppose you bought a bond with an annual coupon of 7 percent Offered Price: $ 4.00 Posted By: katetutor Updated on: 02/03/2017 11:23 PM Due on: 02/04/2017 Question # 00476648 Subject Finance Topic Finance Tutorials: 1 Question : Question Suppose you bought a bond with an annual coupon ... The bond sells for $905 today. a. Assuming a $1,000... Question Suppose you bought a bond with an annual coupon rate of 8.8 percent one year ago for $911. The bond sells for $954 today. a. Assuming... Q2uestion Suppose you bought a computer for $5,000 three years ago. It isdepreciated as a three-year property class, where the percentagesare 33. ... Solved Suppose you bought a bond with an annual coupon of 7 - Chegg Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? (Do not round intermediate calculations Answered: Suppose you bought a 7 percent annual… | bartleby Transcribed Image Text: Suppose you bought a 7 percent annual coupon, a 20-year bond last year when it was first issued. You paid 1,000 for a 1,000 face value bond. The yield-to-maturity of your bond was therefore 7%. If interest rates suddenly rise to 15 percent this year, and hence your bond now has to deliver a 15% yield to maturity.

[Solved]: Suppose you bought a 7 percent annual coupon, a 2 Suppose you bought a 7 percent annual coupon, a 20 -year bond last year when it was first issued. You paid 1,000 for a 1,000 face value bond. The yie... | answersarena.com

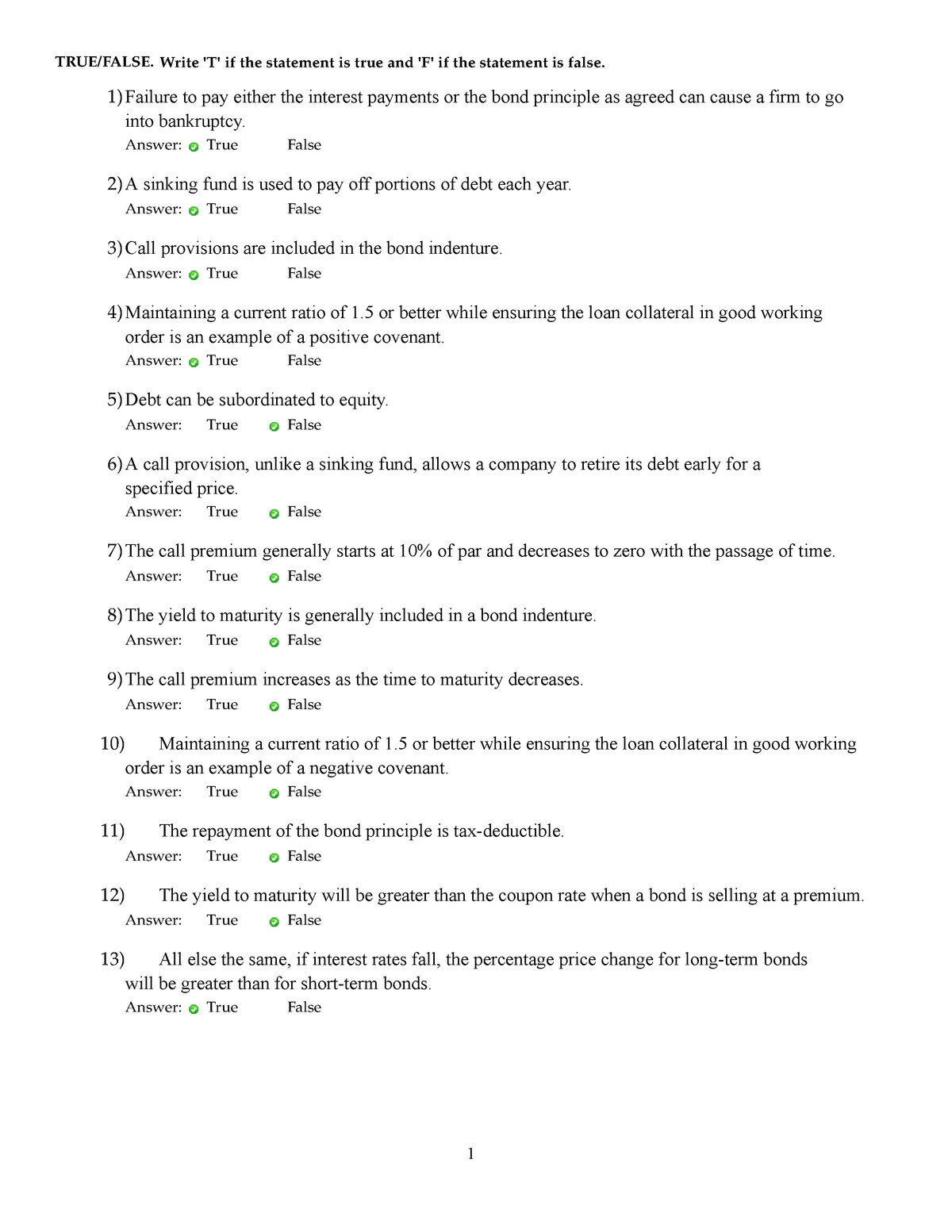

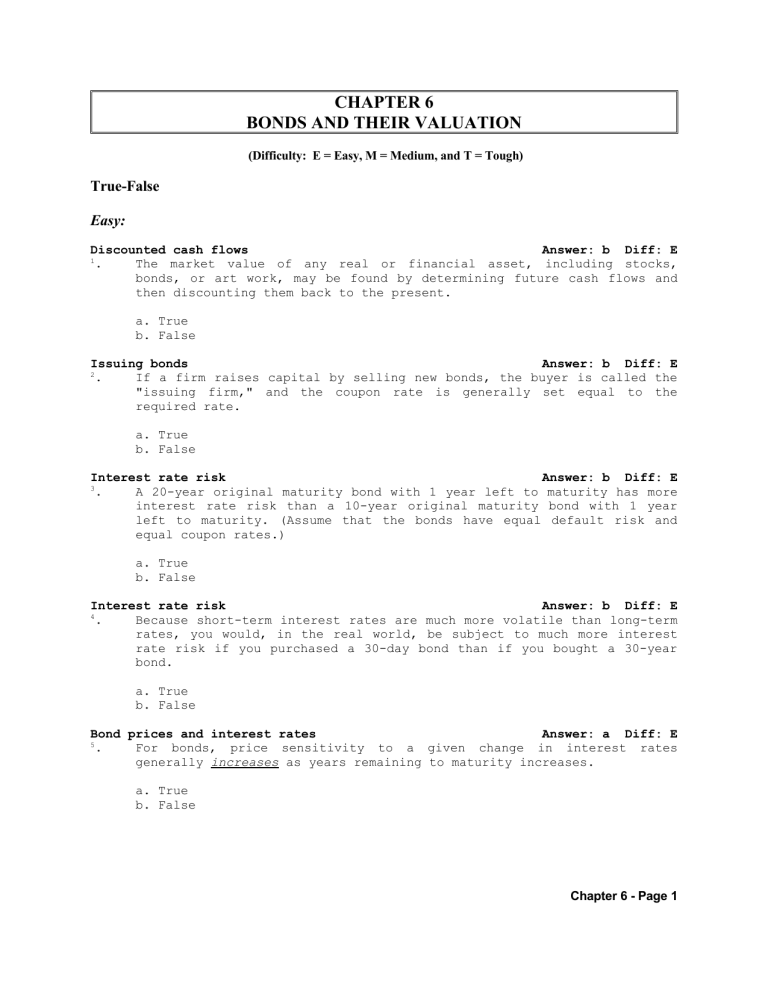

Chapter 5 Flashcards | Quizlet The real risk-free rate is 2.05%. Inflation is expected to be 3.05% this year, 4.75% next year, and 2.3% thereafter. The maturity risk premium is estimated to be $0.05 \times(t-1) \%$, where t=number of years to maturity. What is the yield on a 7-year Treasury note?

Answered: A corporate bond maturing in 15 years… | bartleby Q: The 7 percent annual coupon bonds of the ABC Co. are selling for $950.41. The bonds mature in 8… The bonds mature in 8… A: Yield to maturity is the rate of return a bond generates in its lifetime assuming to be held till…

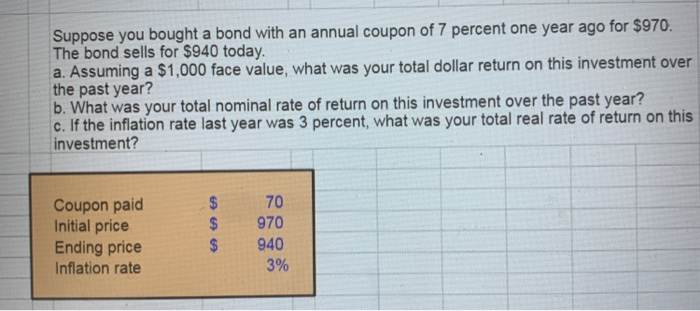

[Solved] Suppose you bought a bond with an annual coupon of 7 percent ... Answer to Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today. a. Assuming a $1,000 face value, what was you | SolutionInn

Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a.Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b.What was your total nominal rate of return on this investment over the past year?

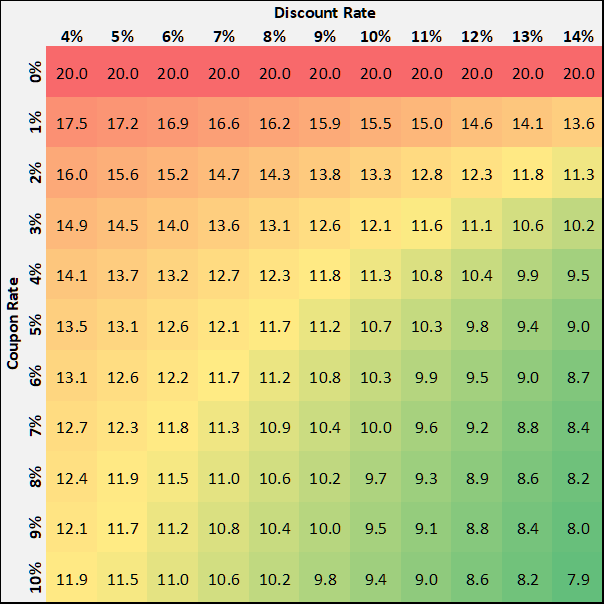

Answered: James has a mortgage of $84,500 at 8%… | bartleby Q: Ashburn Company issued 15-year bonds two years ago at a coupon rate of 9.4 percent. The bonds make… A: Lets assume face value of the bond = $1000 Semiannual coupon amount = $47 (i.e. $1000 * 0.094 / 2)…

Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

Suppose you bought a bond with an annual coupon rate of 7...get 5 Answer of Suppose you bought a bond with an annual coupon rate of 7 percent one year ago for $860. The bond sells for $890 today. a. Assuming a $1,000 face...

Accounting Terminology Guide - Over 1,000 Accounting and Aug 10, 1993 · Coupon INTEREST rate on a DEBT SECURITY the ISSUER promises to pay to the holder until maturity, expressed as an annual percentage of FACE VALUE. Coupon Bond A BOND that is usually not registered with the issuing CORPORATION but instead bears interest coupons stating the amount of INTEREST due and the payment date.

![Solved] A 20-year, $1,000 par value bond has a 9% semi-annual ...](https://www.cliffsnotes.com/tutors-problems/assets/img/attachments/20153955.jpg)

![Answered: 4. Calculating Returns [LO1] Suppose… | bartleby](https://content.bartleby.com/qna-images/question/4ed9bdea-3a41-49ec-a684-f00d4b6b8d3d/8fd2ac2f-5447-46a5-acf3-3441dc616c9a/0aq6elm.png)

Post a Comment for "44 suppose you bought a bond with an annual coupon of 7 percent"